Maximize Profits with AI-Driven Embedded Insurance Transforming Data into Results

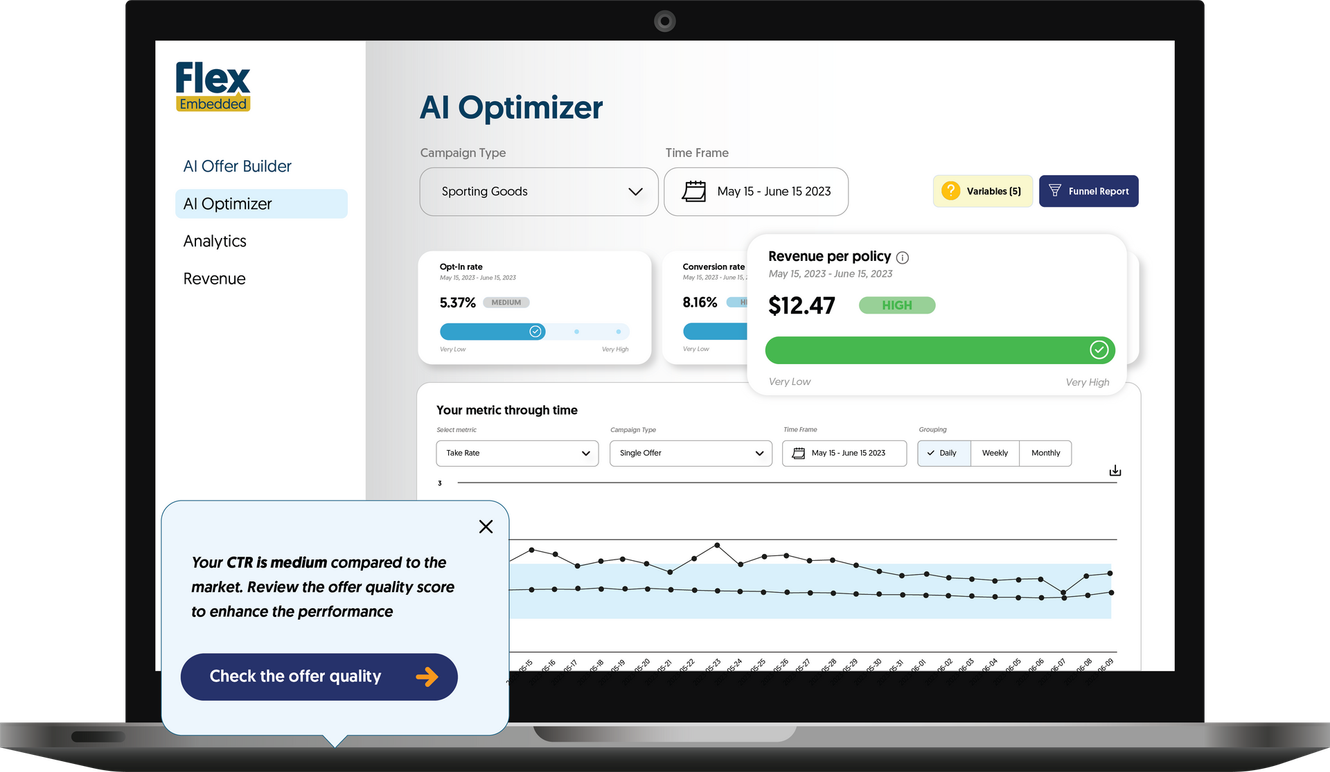

Instant Personalization and Optimization

Flex Embedded's AI enhanced system swiftly tailors insurance offers to customer needs, increasing opt-in rates.

Additionally, we test and optimize offers in real-time, refining them based on customer response. This ensures continuous product improvement and relevance.

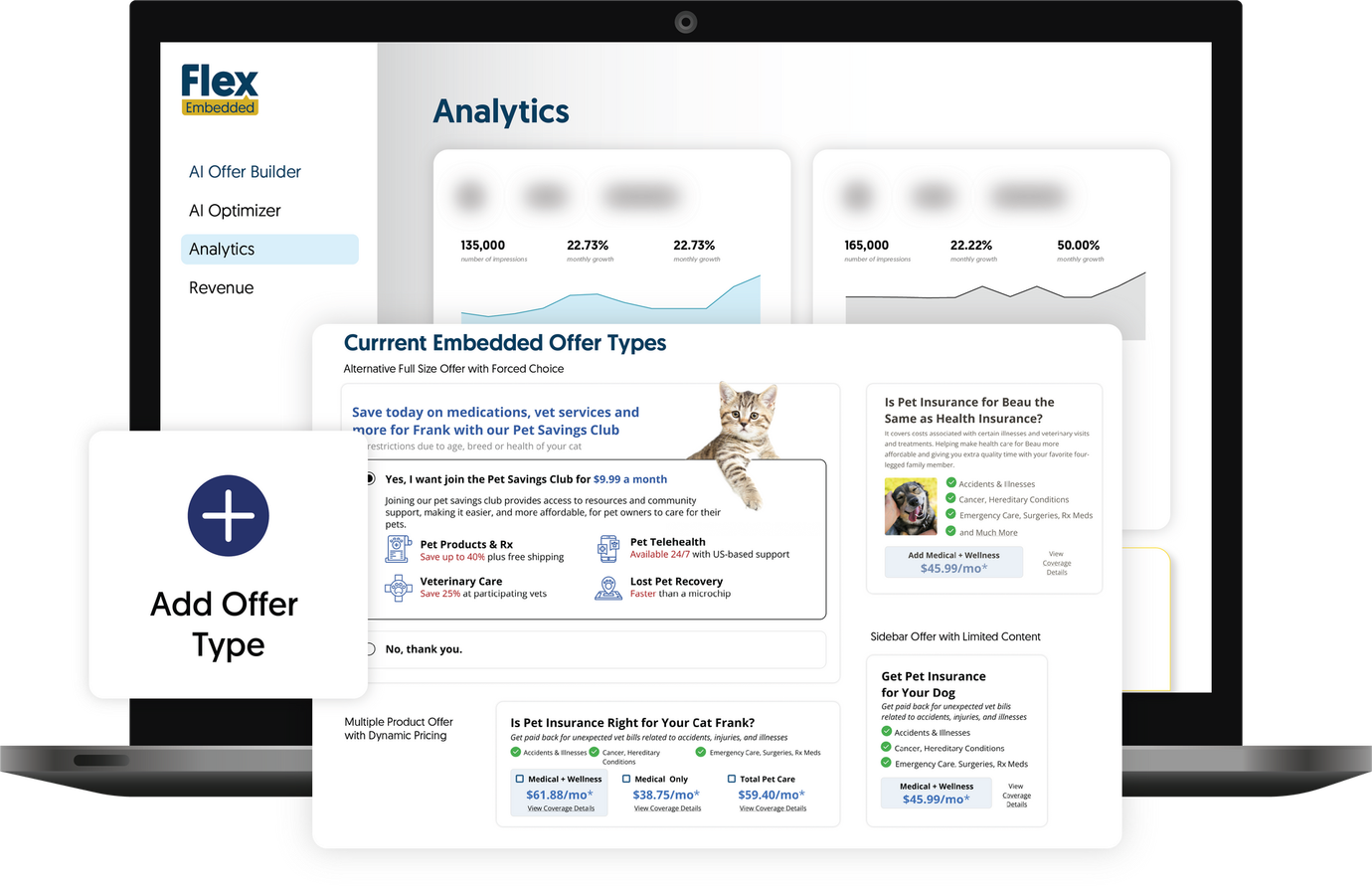

Enhanced Customer Satisfaction

Our AI powered approach surpasses traditional methods by creating offers through data-driven personalization, real-time optimization, scalable efficiency, and improved risk assessment.

These features ensure offers are more relevant, timely, and appropriately priced, enhancing customer satisfaction and business performance.

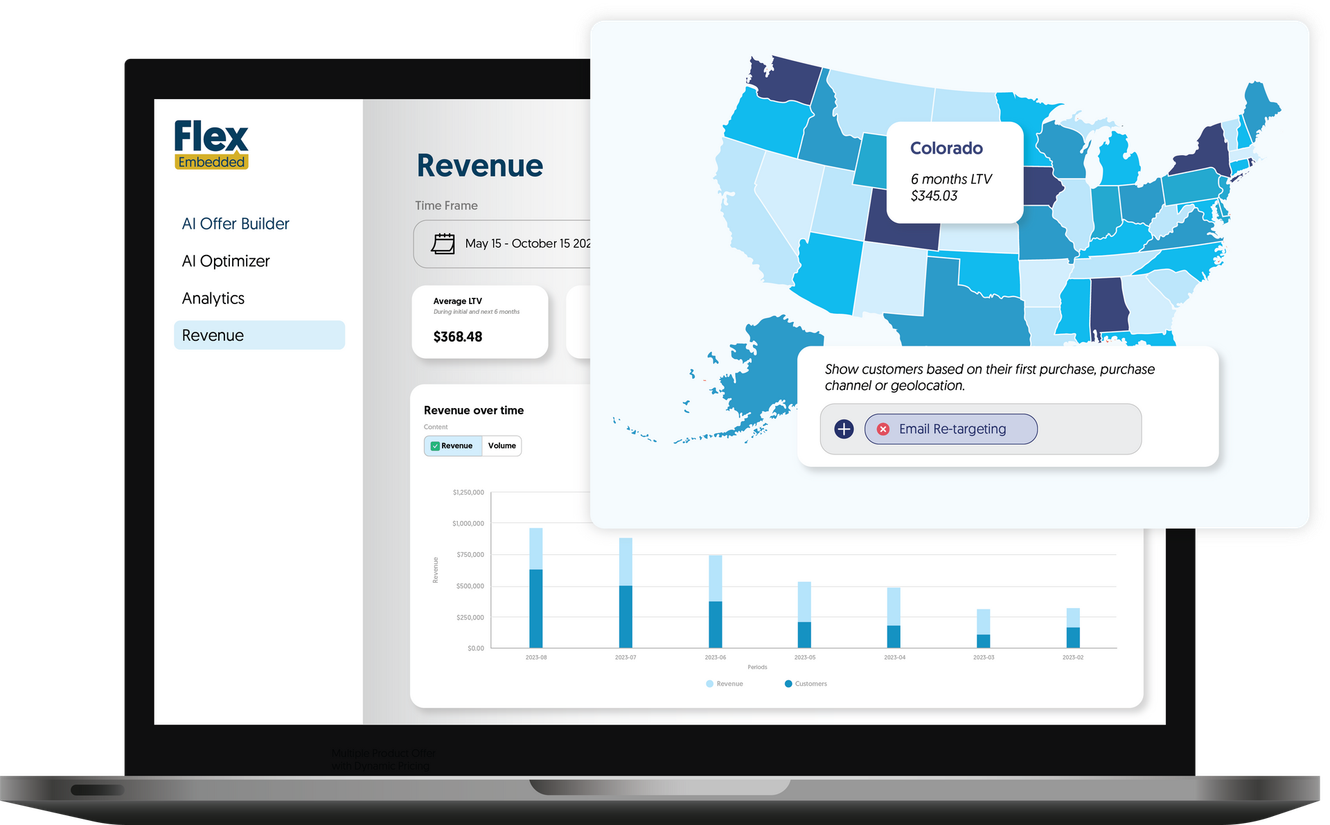

Affordable for Customers, Profitable for You

Tailored coverage and dynamic pricing benefit customers, while upselling opportunities and operational efficiency boost your profits. Experience increased customer loyalty and gain strategic insights.

Implement Quickly and Start Selling

Our agile approach ensures seamless integration of our innovative solutions into our partners' offerings. With a customer-centric focus, we deliver value and meet the evolving needs of our clients.

$1.4B Annual GWP

revenue generated for businesses we have worked with

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

This is a paragraph. Writing in paragraphs lets visitors find what they are looking for quickly and easily.

This is a paragraph. Writing in paragraphs lets visitors find what they are looking for quickly and easily.

APIs

Our custom APIs for embedded insurance allows for seamless integration of insurance products into any platform, providing a more convenient and accessible experience for customers.

Widgets

Our embedded insurance widgets allow for the integration of insurance products into existing websites or applications, making it easier for customers to purchase from a familiar interface.

Microsites

Our targeted insurance microsites allow for the creation of targeted and personalized landing pages that focus on specific insurance products, making it easier for customers to find and purchase the coverage they need.

Make

more revenue

with each sale

Embedded Insights

Stay up-to-date on key trends and insights